Verification infrastructure

for construction finance.

Verification infrastructure

for construction finance.

Banks, QS firms, and developers — connected through a single auditable layer.

Faster drawdowns. Fewer disputes. Audit-ready from day one.

Banks, QS firms, and developers — connected through a single auditable layer. Faster drawdowns. Fewer disputes. Audit-ready from day one.

For Banks

Monitor risk in real time

Portfolio-wide visibility into project status, certifications, and draw requests.

For Banks

Monitor risk in real time

Portfolio-wide visibility into project status, certifications, and draw requests.

For Banks

Monitor risk in real time

Portfolio-wide visibility into project status, certifications, and draw requests.

For QS Firms

Submit once, work everywhere

Standardised certification formats that meet every lender's requirements.

For QS Firms

Submit once, work everywhere

Standardised certification formats that meet every lender's requirements.

For QS Firms

Submit once, work everywhere

Standardised certification formats that meet every lender's requirements.

For Developers

Track every drawdown

See what's approved, what's pending, and what's needed to release the next payment

For Developers

Track every drawdown

See what's approved, what's pending, and what's needed to release the next payment

For Developers

Track every drawdown

See what's approved, what's pending, and what's needed to release the next payment

One platform. One record. Total visibility.

One platform. One record. Total visibility.

BankBuild connects lenders, QS firms, and developers around a shared, auditable view of every project.

No disconnected spreadsheets. No chasing emails. Just real-time verification that moves money faster.

BankBuild connects lenders, QS firms, and developers around a shared, auditable view of every project.

No disconnected spreadsheets. No chasing emails. Just real-time verification that moves money faster.

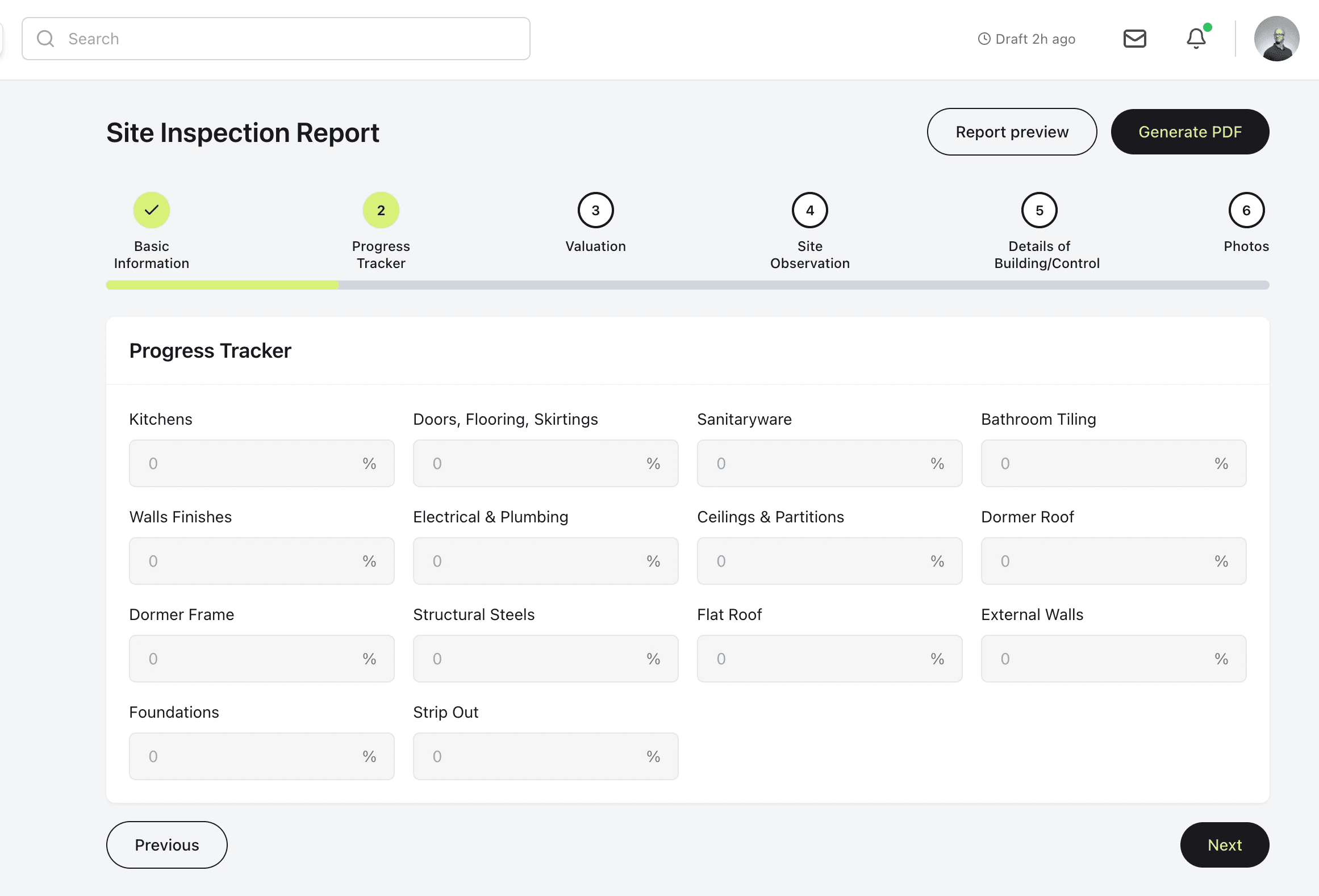

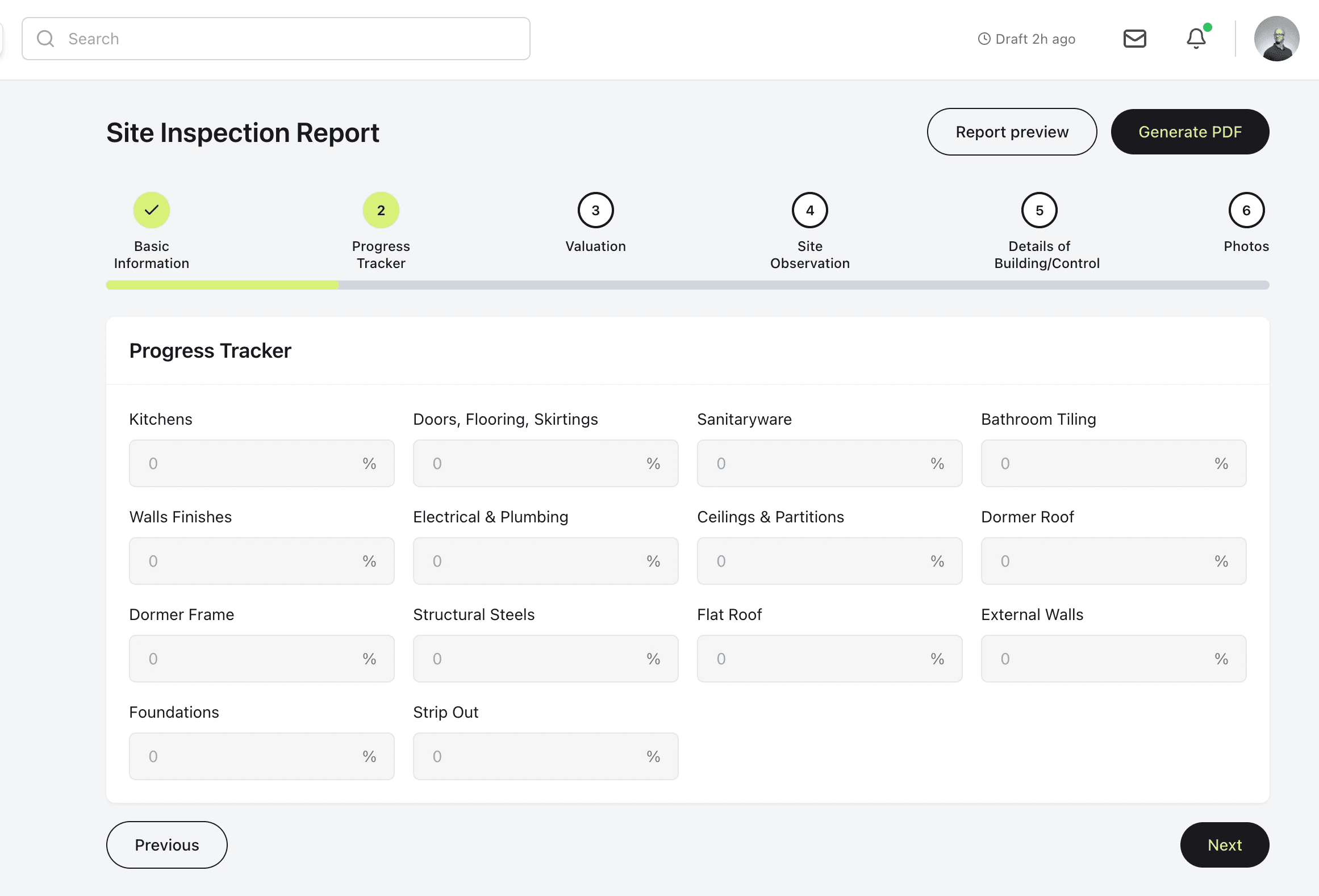

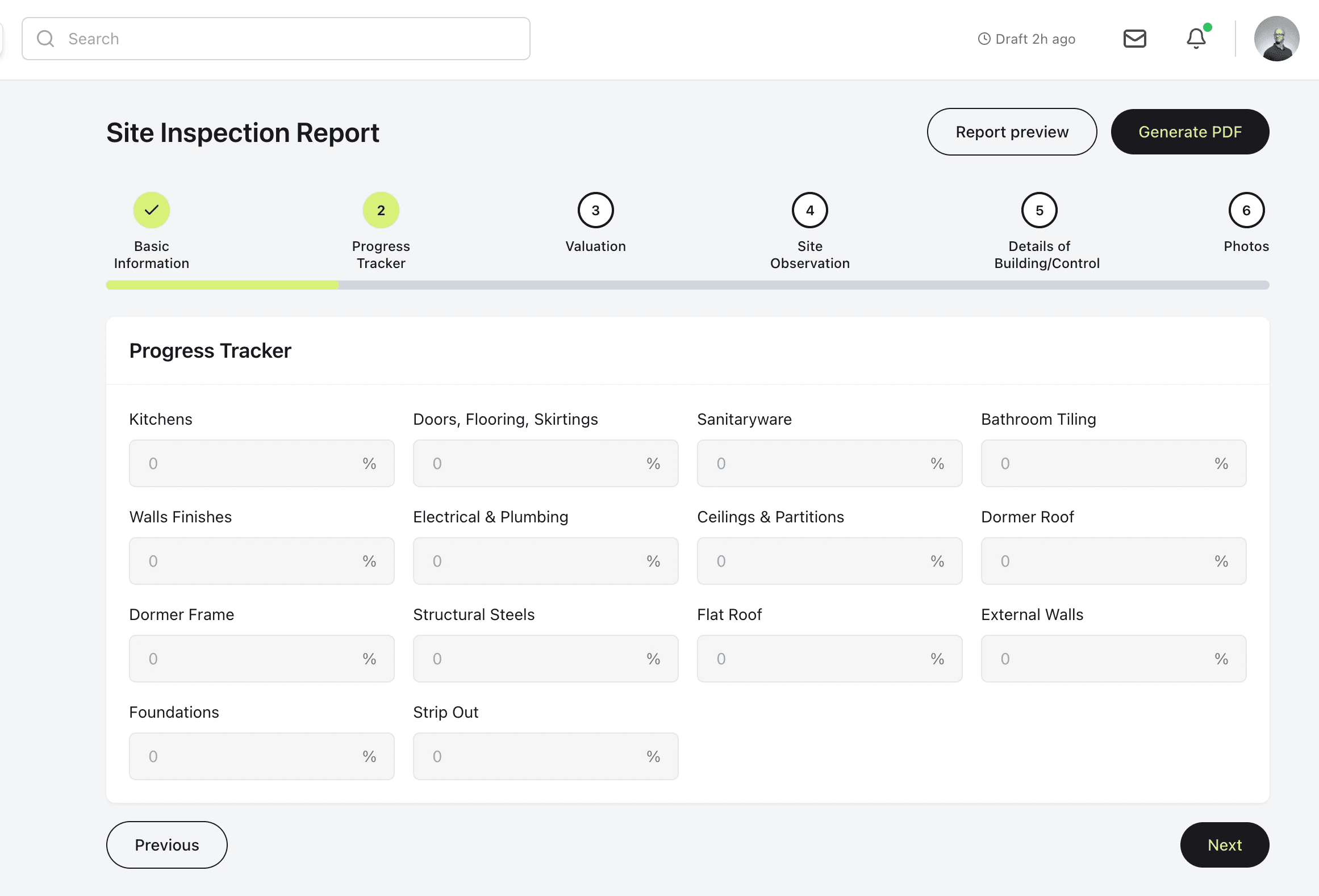

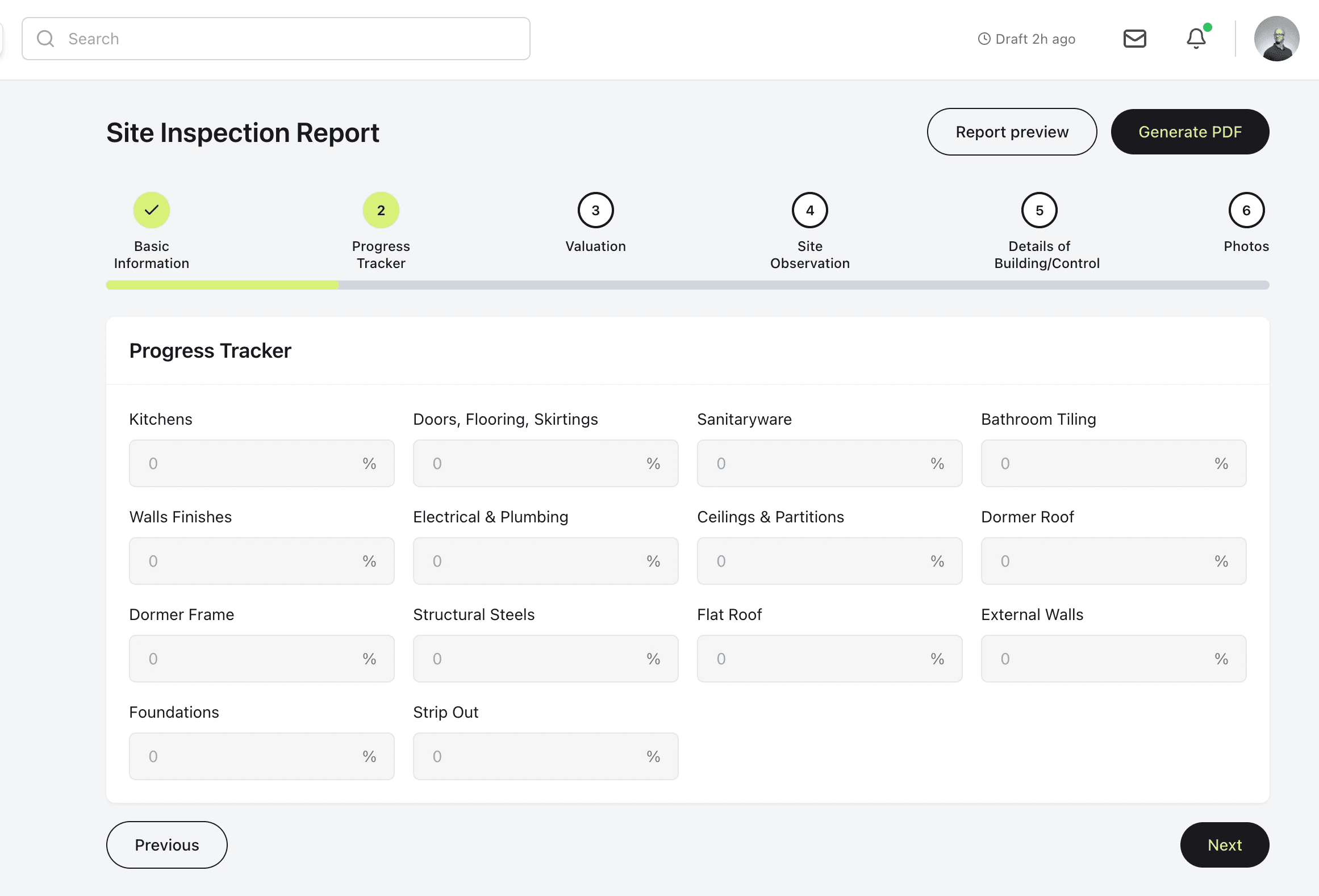

Platform overview

Built for UK construction lending — aligned with RICS guidance on auditability and accountability.

AI-Generated Reports

RICS-ready progress reports, generated instantly with full audit trails and evidence baked in.

Drawdown tracker

Live comparison of verified site progress vs lender milestones — no manual reconciliation.

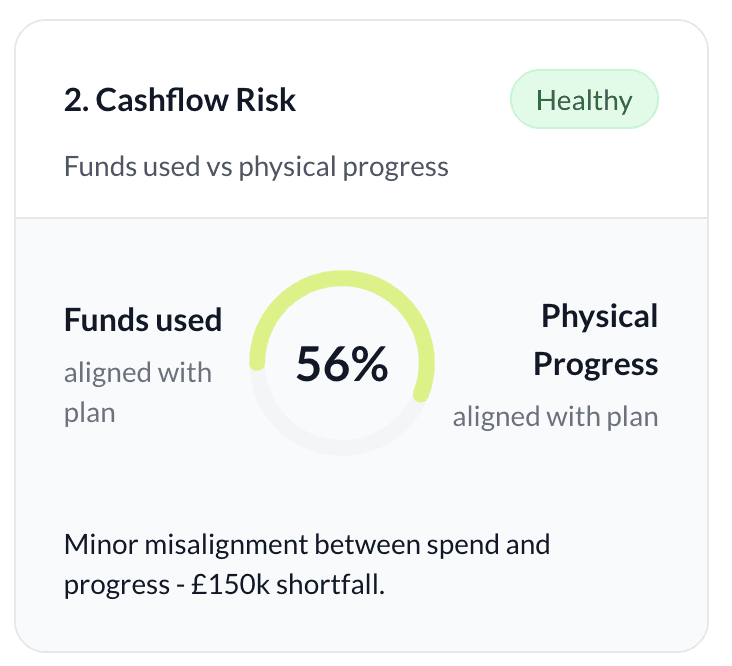

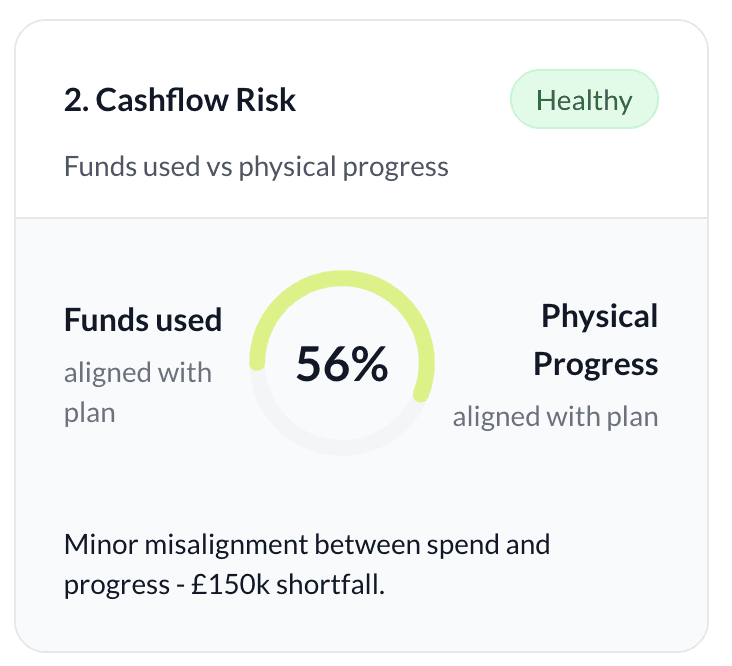

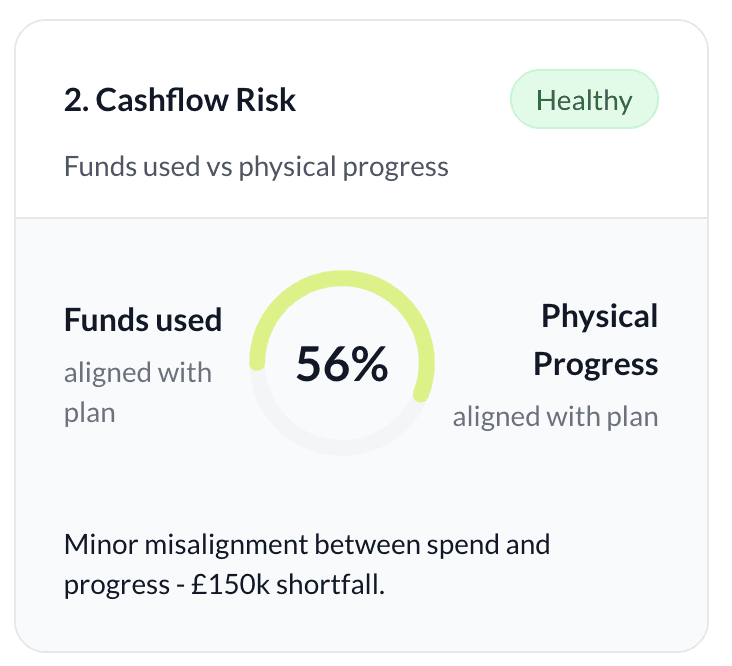

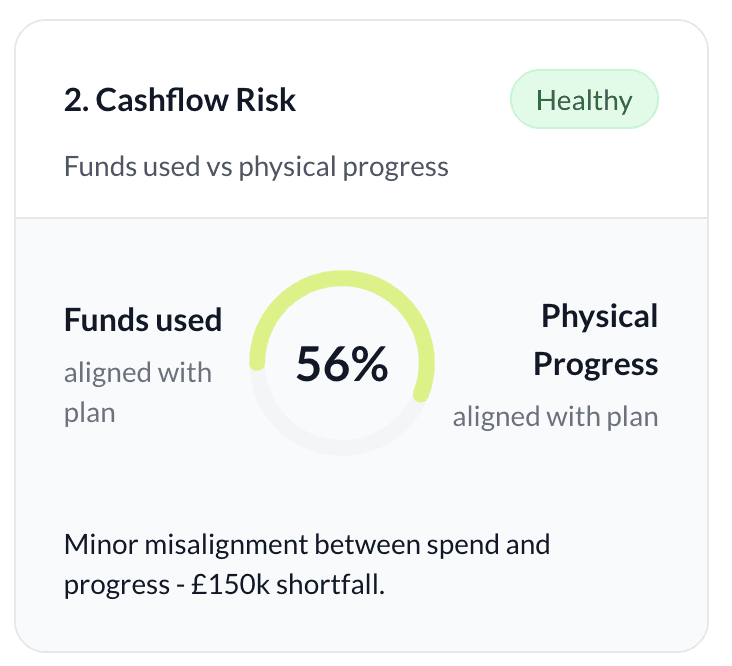

Risk & Spend Intelligence

Real-time visibility on spend, exposure, and risk signals across every active deal.

Built for regulated environments.

Bank-grade security and audit-ready infrastructure — built for lender oversight and regulatory confidence.

End-to-end encryption

All data is encrypted in transit (TLS 1.2+) and at rest (AES-256). Your project information stays protected across every stakeholder.

Immutable audit trail

Every upload, edit, and approval is time-stamped, versioned, and permanently recorded — creating a tamper-proof digital record ready for audit and compliance.

UK data residency

All data is stored in UK-based data centres, ensuring compliance with local regulatory requirements.

Role-based access control

Banks, QS firms, and developers each see only what they're authorised to access — with permissions managed centrally.

How to get started

Get up and running in three simple steps — no heavy setup, no long onboarding.

Step 1 — Request access

Request access — Tell us about your team. We'll respond within 24 hours.

Step 2 — Your workspace

We configure your workspace - your dashboard is set up to match your workflow. No heavy onboarding.

Step 3 — Verify your first project

Upload progress data. BankBuild handles verification and audit trails automatically.

Platform overview

Built for UK construction lending — aligned with RICS guidance on auditability and accountability.

AI-Generated Reports

RICS-ready progress reports, generated instantly with full audit trails and evidence baked in.

Drawdown tracker

Live comparison of verified site progress vs lender milestones — no manual reconciliation.

Risk & Spend Intelligence

Real-time visibility on spend, exposure, and risk signals across every active deal.

Built for regulated environments.

Bank-grade security and audit-ready infrastructure — built for lender oversight and regulatory confidence.

End-to-end encryption

All data is encrypted in transit (TLS 1.2+) and at rest (AES-256). Your project information stays protected across every stakeholder.

Immutable audit trail

Every upload, edit, and approval is time-stamped, versioned, and permanently recorded — creating a tamper-proof digital record ready for audit and compliance.

UK data residency

All data is stored in UK-based data centres, ensuring compliance with local regulatory requirements.

Role-based access control

Banks, QS firms, and developers each see only what they're authorised to access — with permissions managed centrally.

How to get started

Get up and running in three simple steps — no heavy setup, no long onboarding.

Step 1 — Request access

Request access — Tell us about your team. We'll respond within 24 hours.

Step 2 — Your workspace

We configure your workspace - your dashboard is set up to match your workflow. No heavy onboarding.

Step 3 — Verify your first project

Upload progress data. BankBuild handles verification and audit trails automatically.

Platform overview

Built for UK construction lending — aligned with RICS guidance on auditability and accountability.

AI-Generated Reports

RICS-ready progress reports, generated instantly with full audit trails and evidence baked in.

Drawdown tracker

Live comparison of verified site progress vs lender milestones — no manual reconciliation.

Risk & Spend Intelligence

Real-time visibility on spend, exposure, and risk signals across every active deal.

Built for regulated environments.

Bank-grade security and audit-ready infrastructure — built for lender oversight and regulatory confidence.

End-to-end encryption

All data is encrypted in transit (TLS 1.2+) and at rest (AES-256). Your project information stays protected across every stakeholder.

Immutable audit trail

Every upload, edit, and approval is time-stamped, versioned, and permanently recorded — creating a tamper-proof digital record ready for audit and compliance.

UK data residency

All data is stored in UK-based data centres, ensuring compliance with local regulatory requirements.

Role-based access control

Banks, QS firms, and developers each see only what they're authorised to access — with permissions managed centrally.

How to get started

Get up and running in three simple steps — no heavy setup, no long onboarding.

Step 1 — Request access

Request access — Tell us about your team. We'll respond within 24 hours.

Step 2 — Your workspace

We configure your workspace - your dashboard is set up to match your workflow. No heavy onboarding.

Step 3 — Verify your first project

Upload progress data. BankBuild handles verification and audit trails automatically.

Platform overview

Built for UK construction lending — aligned with RICS guidance on auditability and accountability.

AI-Generated Reports

RICS-ready progress reports, generated instantly with full audit trails and evidence baked in.

Drawdown tracker

Live comparison of verified site progress vs lender milestones — no manual reconciliation.

Risk & Spend Intelligence

Real-time visibility on spend, exposure, and risk signals across every active deal.

Built for regulated environments.

Bank-grade security and audit-ready infrastructure — built for lender oversight and regulatory confidence.

End-to-end encryption

All data is encrypted in transit (TLS 1.2+) and at rest (AES-256). Your project information stays protected across every stakeholder.

Immutable audit trail

Every upload, edit, and approval is time-stamped, versioned, and permanently recorded — creating a tamper-proof digital record ready for audit and compliance.

UK data residency

All data is stored in UK-based data centres, ensuring compliance with local regulatory requirements.

Role-based access control

Banks, QS firms, and developers each see only what they're authorised to access — with permissions managed centrally.

How to get started

Get up and running in three simple steps — no heavy setup, no long onboarding.

Step 1 — Request access

Request access — Tell us about your team. We'll respond within 24 hours.

Step 2 — Your workspace

We configure your workspace - your dashboard is set up to match your workflow. No heavy onboarding.

Step 3 — Verify your first project

Upload progress data. BankBuild handles verification and audit trails automatically.

Ready to streamline your construction lending?

Ready to streamline your construction lending?

For banks

For banks

Construction loan administration

Construction loan administration

Construction loan administration

Construction loan administration

Draw & Budget Management

Draw & Budget Management

Draw & Budget Management

Draw & Budget Management

Draw inspections

Draw inspections

Draw inspections

Draw inspections

Risk & compliance oversight

Risk & compliance oversight

Risk & compliance oversight

For quantity surveyors

For quantity surveyors

Progress verification

Progress verification

Progress verification

Progress verification

RICS-ready reporting

RICS-ready reporting

RICS-ready reporting

RICS-ready reporting

Audit trails & evidence logs

Audit trails & evidence logs

Audit trails & evidence logs

Audit trails & evidence logs

Lender collaboration

Lender collaboration

For developers

For developers

Project financials

Project financials

Project financials

Project financials

Budget & cashflow tracking

Budget & cashflow tracking

Budget & cashflow tracking

Budget & cashflow tracking

Draw submissions

Draw submissions

Draw submissions

Draw submissions

Funding visibility

Funding visibility

Company

Company

About

About

About

About

Security & Compliance

Security & Compliance

Security & Compliance

Security & Compliance

Insights (Blog)

Insights (Blog)

Insights (Blog)

Insights (Blog)

Investment & partnerships

Investment & partnerships

Investment & partnerships

Investment & partnerships

©2026 bankbuild, Inc. All rights reserved. Privacy Policy & Terms.

©2026 bankbuild, Inc. All rights reserved. Privacy Policy & Terms.